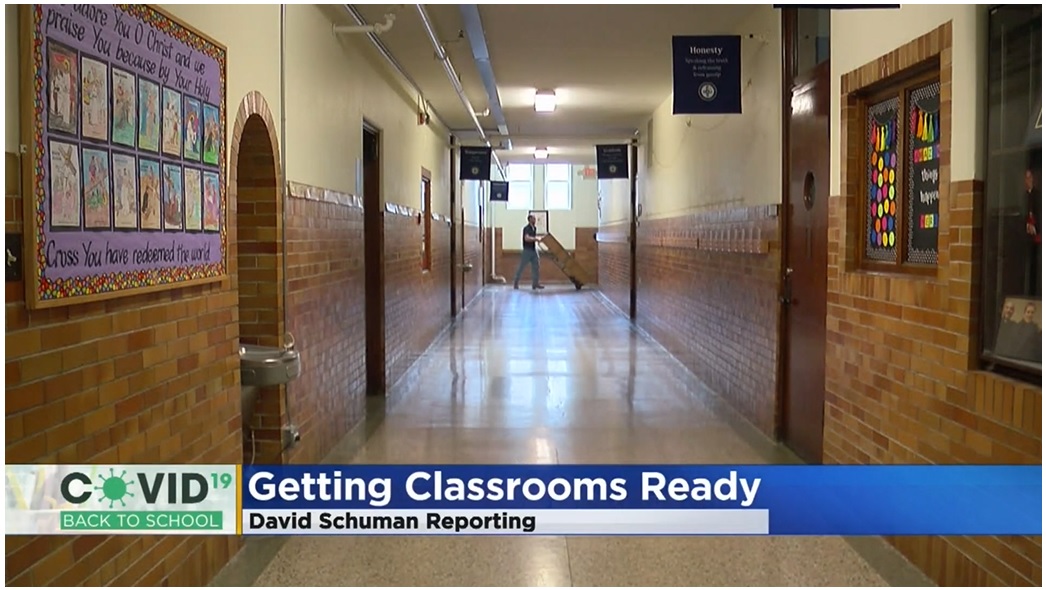

There is cause for celebration! A federal tax credit for contributions to Scholarship Granting Organizations (SGOs) was included in the federal budget bill that was signed into law on July 4, 2025. Known as the Educational Choice for Children Act, this is the first school choice legislation that has passed at the national level, making it a true milestone for education freedom.

The measure creates a dollar-for-dollar federal tax credit for contributions to SGOs in Minnesota, like the Aim Higher (Catholic) Foundation, various Lutheran tuition assistance foundations, and the Torah Academy Scholarship Fund.

How the tax credit will work: The new tax credit will take effect in 2027, and is permanent, with no date to expire. It also does not have an overall cap (so the tax credits will not “run out”). However, the maximum tax credit amount for everyone is $1,700 per year. The U.S. Treasury Department will oversee the federal tax credits.

What the tax credit can mean for you: Beginning in 2027, you can donate up to $1,700 to an approved SGO at no extra cost. Instead of sending that amount to the IRS, you can redirect it to an SGO. Every dollar you give to an SGO counts as a dollar-for-dollar credit on your federal income taxes.

For example, if you owe $10,000 to the IRS, you can redirect $1,700 to an SGO. Your IRS bill will be reduced to $8,300, and the $1,700 instead funds scholarships — helping children at no extra cost to you.

State opt-In: To participate, the governors of Minnesota and other states must opt into the program. Specifically, governors must authorize SGOs to operate in their respective states by submitting a list of approved SGOs to the U.S. Treasury Department by January 1 each year.

In summary: This tax credit can be a major boost to public and private education in Minnesota, permanently increasing the funds available to both and giving many more parents a choice and children a chance.

Frequently Asked Questions

Q: What is the primary benefit of the federal tax credit to students?

A: The new program gives students access to more — and larger — educational scholarships that parents can use for a wide range of K–12 expenses, including private school tuition, books, supplies, tutoring, and special needs services. There are no limits on the size of scholarships that an SGO can award to an eligible student.

Q: Can students who attend public schools receive scholarships?

A: Yes. Students in public schools are eligible to receive scholarships. These funds can be used for a variety of educational purposes, including tutoring and after-school programs. The program gives families flexibility in how they use the scholarships to support their children’s education regardless of the school they attend.

Q: Is there an income cap on families who can receive scholarships?

A: Yes. Students are eligible for scholarships if their family’s household income is at or below 300% of the area median gross income (AMGI) for their county or metropolitan area. This means that the income cap varies by county. For example, the 300% threshold is approximately $195,000 for a family of four in Hennepin County.

Q: What is the primary benefit to taxpayers who make a qualified contribution to an SGO?

A: The law allows individuals to receive a dollar-for-dollar tax credit for qualified contributions. That means a taxpayer can donate up to $1,700 per year at no cost to the taxpayer. There is no minimum donation required to receive a tax credit.

Q: How would the federal tax credit be different from a charitable deduction?

A: A tax credit would allow you to reduce your tax liability dollar-for-dollar by the amount of your donation. For example, the same $1,000 donation under the tax credit would reduce your tax liability by $1,000. By contrast, the value of a charitable deduction is less and depends on your marginal tax rate and whether you itemize or apply the standard deduction. For example, if you are in the 22% tax bracket and itemize, a $1,000 donation saves you $220.

Q: What is a qualified contribution?

A: A qualified contribution is a charitable contribution to an SGO that provides scholarships for eligible students in states that have opted into the program.

Q: How many tax credits are available under the program?

A: The program does not have an overall cap on the amount of tax credits available per year (so the tax credits will not “run out”). However, each taxpayer can only claim up to $1,700 in tax credits per year.

Q: Who will be eligible to receive a federal tax credit?

A: Any individual with a federal tax liability who files a Federal 1040 Form can apply for a tax credit for a donation to an eligible SGO.

Q: What steps do I have to take to apply for and receive a federal tax credit?

A: The U.S. Treasury Department is currently promulgating rules that will include instructions regarding the tax credits. We will be sure to keep you posted throughout the process.

Q: When can I begin applying for a tax credit?

A: Under the law, individuals can receive a tax credit for donations made after December 31, 2026, and taken against income on their 2027 federal tax return filed typically in 2028. Taxpayers can also change their withholding or reduce their estimated taxes in the same year they donate.

Q: Can I donate from my donor-advised fund (DAF) and receive a tax credit?

A: No. Gifts made through DAFs are not eligible for the tax credit since the donor receives a federal tax benefit upon investing money in a DAF rather than when a donation is made through the DAF.

Q: Can I donate stocks and receive a tax credit?

A: No. Stock gifts are not eligible for the federal tax credits.

Q: If I donate to a state tax credit program, can I get a tax credit on both my state and federal taxes?

A: No. The bill does not allow an individual to claim tax credits for the same donation on both their state and federal taxes. However, you can donate to an SGO that administers a state tax credit program and claim a tax credit on your state tax return and then make a second donation to the same SGO and claim a federal tax credit on the second donation.

Q: Is it possible that Governor Tim Walz will not opt Minnesota into this program?

A: Yes. Governor Walz may choose to keep Minnesota out of the federal educational tax credit program, even though public-school students can receive these scholarships.

Q: What does the program cost the State of Minnesota and public schools?

A. Nothing. The program has no impact on state tax revenues and does not reduce state or federal funding for Minnesota’s public schools. Put simply, there is no fiscal justification for any Minnesota elected official to oppose opting in. Opposition would be based on politics, not finances.

Q: What if Minnesota does not opt in to the program? Can I donate to an SGO in another state?

A: Yes. You may give to an SGO in another state if the governor of the second state approves the SGO. The federal tax credits will be awarded to you through the U.S. Treasury Department rather than your state government or the SGO’s state government.

Q: Where can I get more information?

A: Subscribe for emails from OAK (Opportunity for All Kids) on its website: www.oakmn.org/subscribe.

Source of tax-related answers: Children’s Scholarship Fund, New York, NY 10018-0102

![[downloaded during free trial]](https://oakmn.org/wp-content/uploads/2025/11/iStock-1430368205-120x86.jpg)