School Choice via Education Savings Accounts (ESAs) are sweeping the nation. Indeed, Louisiana is about to become the 12th state to adopt universal ESAs.

The speed of change since COVID is simply incredible. Parents saw the system and the teachers’ unions for what they are and decided it’s time for a change.

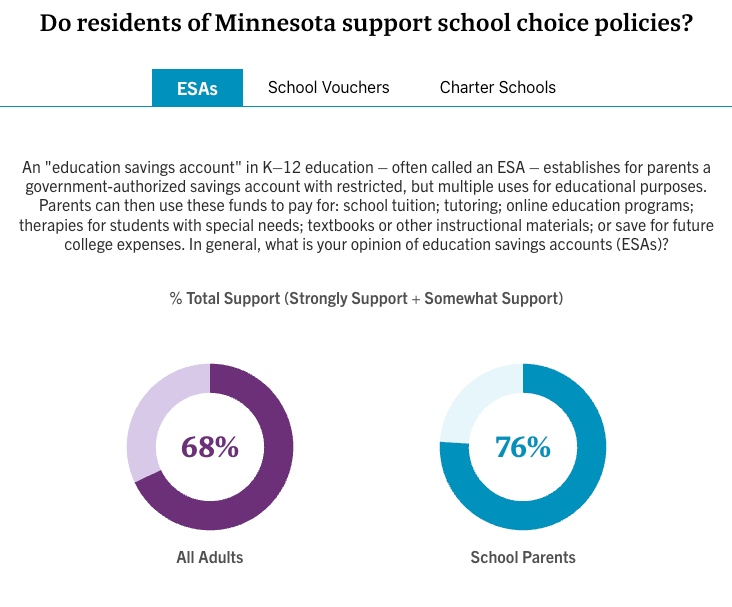

Here in Minnesota, 76% of parents support bringing Education Savings Accounts to the state.

In conversations with parents, community leaders, educators, students, and the public, the popularity of ESAs centers conceptually around the freedom for parents to find the best schools for their children.

When you explain how ESAs work and how they will transform education in America and Minnesota, we find Minnesotans of all stripes are even more excited and supportive. They see the enormous potential!

So, how do ESAs work? And how would they work in Minnesota?

The Education Savings Account or ESA operates very much like a Health Savings Account or HSA. With a HSA, you or your employer or both make a pre-tax deposit into the account. Then you, the owner of the HSA, receives a debit card linked to the account and you are then free to use the debit card at any doctor of your choice for a wide variety of medical services such as surgery, check-ups, and even chiropractic care. You can even use the HSA for purchasing prescriptions and qualifying medical supplies.

An ESA operates similarly.

A parent or guardian would apply for an ESA for each school-aged child. Upon approval, the state would deposit an equally allotted amount of funds into each ESA. The parents or guardians would then receive a debit card which can be used to pay for tuition at any school as well as for tutoring, supplies, and extra-curricular activities. If the funds are not fully used, they remain in the ESA and can be saved for future tuition costs and even college, trade school, or continuing education expenses.

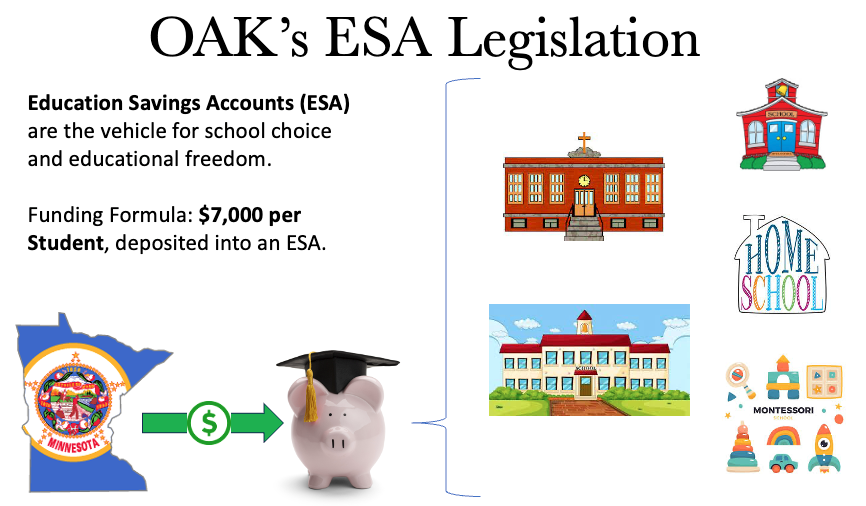

Here’s how ESAs would work in Minnesota based on OAK’s proposed legislation. (SF 3435 and HF 5123)

Not including local property taxes, federal revenue, and district-specific grants, Minnesota’s most recent biennium budget allots $20.2 billion to E-12 education. That’s nearly 40% of the state’s total spending. There is no lack of spending on education, it’s how it’s spent that’s the problem.

Of all the money dedicated to education by the state, there is a general allotment of roughly $7,000 per student. On top of that base amount, you then pile on a wide variety of opaque spending for mandates and programs, local property taxes, federal revenue, and grants to end up with many school districts around the state spending $20,000 or more per student per year – substantially more than many private schools.

For ESAs in Minnesota, we’re only focusing on that basic allotment of $7,000. This amount is on par with other states’ ESA programs, which range from $6,500 to a little over $8,000 per student.

Once our legislation is passed, a parent or guardian can apply for an ESA for each of his or her school-aged children. Upon approval, the family would then receive a debit card linked to an Education Savings Account for each student. The state’s basic allotment of $7,000 per student previously discussed would then be deposited into the Education Savings Account rather than going directly to a school district. In this way, the dollars directly support students, not systems.

At that point, the parents or guardians have both the freedom and the resources to choose the school that best matches each of their children. If a parent needs to pay for tuition, he or she would use the ESA debit card to do so. If funds remain after tuition, that same parent can use those funds for tutoring, supplies, extra-curricular activities, or to be saved for college.

In states with ESAs, we’re already seeing parents coming together with educators to start neighborhood schools, co-ops, micro-schools, and other innovative approaches to education that best suit the families and the students.

And that’s why there is so much excitement and demand for ESAs.

Education Savings Accounts will unleash incredible innovation and flexibility in education. Imagine every student in the state of Minnesota having both the freedom and resources to choose the best school or educational path.

At this very moment, it’s guaranteed that many parents across Minnesota want to find different schools for their children due to issues such as bullying, curriculum, ideological divisiveness, religious values, academic offerings, violence, specialization, personalities, school culture, and discipline.

But if parents don’t have the funds to leave, they’re forced to keep their children in a failing district or a school that simply isn’t a good fit. Children trapped in the wrong school often fall behind academically, suffer from anxiety or depression, and are prevented from truly flourishing.

Education Savings Accounts can solve all those problems by giving parents the freedom and resources to choose. Likewise, with the dollars following the students, many educators can start new schools with a variety of curriculum options and learning cultures knowing they have an opportunity for funding unlike any time before.

The opportunity to make real progress in education is already sweeping the nation. If Minnesota hopes to keep up, it’s time to transform education and unleash innovation with Education Savings Accounts.

—

Image Credit: Pexels

![[downloaded during free trial]](https://oakmn.org/wp-content/uploads/2025/11/iStock-1430368205-120x86.jpg)